Why Would Companies Use Soft Pulls?

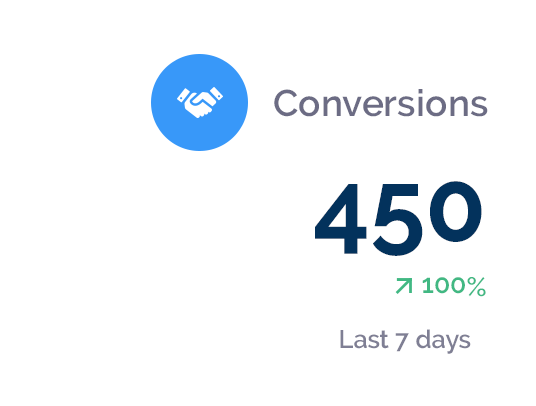

Get More Leads Online and Generate More Revenue:

Because a soft credit check can be done with a name and address only and does not impact a consumer's credit, consumer's are more willing to fill out pre-qualification applications. This is because it takes less time than filling out a full length application online (people hate filling out long applications) and customer's are reluctant to give out their social security number.

Convert More Leads With Verbal Consent:

With verbal consent on a recorded line, finance professionals can pull their client's credit report and FICO® Score. We have found that consumers convert at a higher rate once they have ran a soft credit check on them. More specifically, once a your company has ran the customers credit, you can speak more intelligently about the deal, and you are also able to "sink your teeth" into the deal.

Save Time and Money:

Running a soft pull will put you "in the know" about your prospect's credit condition at the beginning of the sales cycle. This will save you time and money from working on deals that do not qualify in the first place.

Protect Your Leads:

Soft pulls do not activate "trigger leads." Because a soft pull does not place an inquiry on a customer's credit report, your competitors trigger leads will not be activated.

Save Money Again:

Soft pulls cost about $3 each... a tri-merge can cost up to $30 per report. Companies using soft pulls save money because they wait until they are confident they have a deal to run a tri-merge and they don't run them on deals that don't close. They can do this because they can get the full credit report from iSoftpull. Also, they are happy to pay the fee for the tri-merge when they are confident hey have a deal.